Fixed Rate RSA Retail Savings Bonds

Current Rates

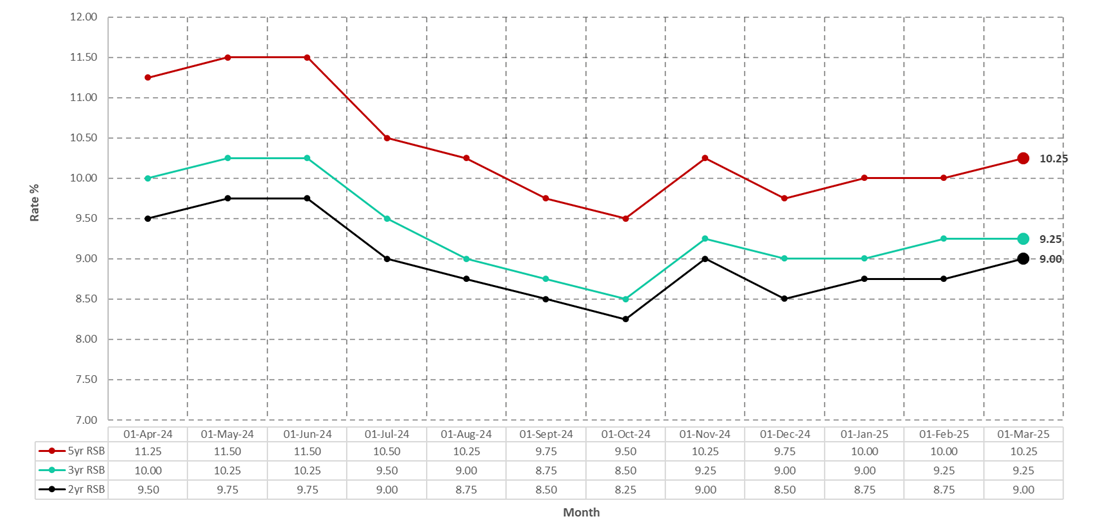

| Fixed Rate RSA Retail Savings Bond Term | Rate % Mar-25 | Month Change % |

| 2 years | 9.00 | +0.25 |

| 3 years | 9.25 | +0.00 |

| 5 years | 10.25 | +0.25 |

February highlighted continued rand volatility, while local geopolitical and policy risk stabilized, and its effect on ZAR and local yields was evident, particularly given the delayed budget. Global inflationary risks are mixed, however geopolitical tensions remain high and the tariff wars commencing. The Rand ended the month 0.22% weaker, with USDZAR closing at 18.70.

The shorter end Government Bond yield curve bear steepened, with yields broadly higher across the entire curve. The short end yield (2-year) rose 10bps, while longer dated (5-year) bond yields rose by 12bps.

Given these Government Bond yield changes and general market conditions:

-

2 and 5-year Fixed Rate RSA Retail Savings Bond yields rose 25bps to 9.00%, and 10.25% respectively,

-

the 3-year Fixed Rate level remained at 9.25%

for the month of March 2025.

RSB spreads to government bonds were wider for the 5-year term bonds, now trending at their long-term averages. The 5-year spread is higher by 0.13% at 1.09%.

-

This means the relative value of RSBs remains high, at the long-term norm for the month of March.

-

RSB rates remain in line with or substantially better than Bank rates.

Rate Commentary for October 2024

Last updated 1 November 2024

Geopolitical conflict and tensions persist, global inflation measures are stabilizing lower, subsequent central bank dovishness and a weaker US Dollar is affecting emerging market bond yields.

Market uncertainties linked to systemic banking and geopolitical risk events are having ripple effects on the local fixed income and Forex market.

Retail Bonds offer substantial value over Government Bond yields, with November seeing the 2, 3 and 5-year fixed rate term spreads at or above their historical averages. The 5-year spread offers 1.06% more than the same term Government bond for the month of November.

The monthly change in underlying Government Bond yields is a good proxy, for any RSB rate changes, however, the spread added to Government Bond yields to arrive at RSB rates can adjust to retail market conditions. RSB rates very remain competitive compared to the Banks.

As depicted in the 5-year Retail Savings Bond Rate versus 5-year Government Bond Rate chart, the 0.47% rise in the 5-year rate with a 0.75% change in the RSB rate means the spread over Government bonds widened, to marginally higher than the average long-term levels for November 2024.

Investment rates for new bonds are set by the National Treasury at the start of each month, and are primarily determined based on the levels at which Government Bonds are trading in the capital markets. By keeping an eye how these bond levels have changed over the month, it is possible to get a good idea what changes, if any can be expected in RSB levels. This information is useful in determining whether to buy or re-start now, or hold off in the hope of better levels next month.

For those interested in more detail in the moves of the RSB bonds relative to Government bonds, more detail is below

How do the RSA Retail Bonds rates compare to Bank Deposit rates?

Most Retail Banks are paying less competitive rates compared to RSBs, particularly for longer term fixed deposits.

Given that the RSBs are:

-

a better credit

-

can be re-started should rates go higher, and

-

can be redeemed reasonably cheaply, after 12 months,

means that they certainly offer great value relative to bank term deposits.

For those able to access these top rates (typically you need to be 60+ and have R100,000 to invest), bank deposits are still worth considering as part of a savings portfolio.

Be sure to visit RateCompare.co.za for an excellent monthly review of all rates offered at most SA Banks.

These rates are ranked: split by investment term, amount invested and age group and include some excellent tools to help compare and improve investment outcomes.

The significant value associated with the re-start option however, means that we continue to favour a larger holding of RSB relative to term bank deposits.

South African Government Bonds

Fixed Rate RSA Retail Savings Bond rates are primarily set off and affected by the yields of Fixed Rate South African Government Bonds traded on capital markets. General market conditions also affect the final Retail Savings Bond rate offered.

As of 31 October 2024, Government Bond Rates were as follows:

| Bond Name | Term to Maturity (Years) | Yield % |

| 12m TB | 1.00 | 8.129 |

| R186 | 2.14 | 8.345 |

| R2030 | 5.25 | 9.270 |

Interpolating the rates as of 31 October 2024, we obtain 2, 3 and 5-year Government Bond Rates

| Interpolated Term (Years) | Interpolated Yield % |

| 2 | 8.32 |

| 3 | 8.60 |

| 5 | 9.19 |